Translate this page into:

Understanding Financial Literacy and Investment Behaviours in Indian Medical Undergraduates

*Corresponding author: Devansh Amit Lalwani, Seth GS Medical College and KEM Hospital, Mumbai, Maharashtra, India. devanshalalwani@gmail.com

-

Received: ,

Accepted: ,

How to cite this article: Singh A, Lalwani DA, Kamath Y, Bhondve A. Understanding Financial Literacy and Investment Behaviours in Indian Medical Undergraduates. Glob J Med Stud. 2024;4:4-8. doi: 10.25259/GJMS_17_2024

Abstract

Objectives:

Financial literacy stands as a cornerstone of individual stability in our evolving society, more so for medical practitioners who navigate a unique set of fiscal challenges. Prolonged educational timelines, coupled with potential debt accrual, often defer the financial stability of these professionals. Moreover, the intensities of their vocation often overshadow the imperative of financial management. This study sought to understand investment perceptions and behaviours among medical students in Mumbai, aiming to identify gaps in financial education and the necessity of bespoke financial literacy programs.

Material and Methods:

A cross-sectional design was employed, targeting undergraduate medical students and interns from selected medical colleges in Mumbai. Participants were purposively sampled based on specific criteria. Data were collected using a structured questionnaire, segmented into knowledge, attitudes and practices related to investment. This questionnaire, with a content validity ratio exceeding 0.65, was validated by professionals to ensure relevance and reliability. Following data collection, statistical analysis was conducted to discern patterns and insights.

Results:

This study analysed the investment knowledge and practices among 280 medical students, with a gender distribution of 61% (171) males and 39% (109) females, aged 18–24 years. A significant majority (79%) were familiar with the procedures to start investing, with 60% (168) actively participating in the stock market. However, perceptions about the stock market were split, with 52% (146) viewing it as a gamble. Notably, digital platforms, especially social media such as YouTube and Instagram, emerged as the primary source of investment knowledge for 91% (255) of participants, followed by family (82%) and friends (62%). Regarding investment habits, 36% (101) had been investing for <6 months, while 25% (70) had investments for over a year. A substantial 75% (210) managed their investments independently. Furthermore, 76% (213) of students expressed interest in seminars or curriculum integration for enhancing financial literacy.

Conclusion:

Concluding the study, the findings underscore a significant gap in financial literacy among medical students. Despite a high level of engagement in investment activities, there is a clear demand for structured financial education, as evidenced by 76% (213) of students advocating for financial literacy seminars or curriculum integration. This highlights an urgent need for educational reforms in medical colleges to equip future healthcare professionals with essential financial management skills.

Keywords

Financial literacy

Investment practices

Medical students

Financial education

Economic challenges

INTRODUCTION

Background and rationale

The Cambridge Dictionary defines financial literacy as the ability to understand basic principles of business and finance. In today’s world, financial literacy is crucial for individuals across all professions and households. However, medical professionals are uniquely challenged due to delayed earnings due to the longer educational career paths they pursue, and they often carry substantial educational debts.1,2 In addition, the demanding nature of their careers leaves little time for financial education, leading to ill-informed decisions that can negatively affect their financial stability and overall well-being which can even impact patient outcomes.3,4 Thus, there is a dire need of increasing financial awareness among medical students.

Financial education plays a key role in empowering medical professionals and students to navigate financial challenges such as budgeting, managing debts, insurance, negotiating employment contracts and estate planning. Building a foundation in financial literacy and investing can help them achieve a semblance of financial stability throughout their education and early working years.5

It is essential to introduce basic personal finance education during medical training, given the prolonged educational path required to become an Indian Medical Graduate. Financial missteps early in a resident’s career, such as inadequate retirement savings or rapid debt accumulation,6 can exacerbate the economic challenges faced by young physicians. Furthermore, the growing trend of medical school graduates pursuing subspecialty careers further magnifies the impact of rising educational costs, as their future earnings are deferred during extended residencies and fellowships. Therefore, integrating financial education into medical training becomes a compelling necessity.

The objective of this research is to study the knowledge, attitudes and practices of investing among medical students in Mumbai. By understanding how medical students perceive investing, we aim to suggest additions to the medical curriculum or foundation courses that can include prerequisites, various modes of investment, portfolio management, market trends and research, evaluation of risks, etc., to foster financial independence and enhance their understanding of the benefits of investing. Overcoming existing barriers and offering comprehensive financial literacy training is crucial to equip future doctors with unbiased expertise in personal finance, empowering them to take control of their financial futures and improve their overall perspectives.

Significance of the study

While preventive medicine and health habits are taught from an early age, formal instruction in personal finance is often overlooked. Resident physicians, despite their high level of education and substantial financial debt, are particularly vulnerable to poor financial management. Many residents and fellows complete their graduate medical education without receiving sufficient unbiased financial planning guidance, leaving them at risk of making ill-informed financial decisions that can harm them and their families.

A pilot study conducted among residents highlights the significant impact of personal finances on their health and well-being.5 Moreover, recent data reveal low levels of financial literacy among medical trainees. These findings underscore the pressing need to explore the extent of financial knowledge among medical students and identify the factors associated with possessing or lacking this knowledge.

Study objectives

The purpose of this study is to assess the knowledge, attitude and practices of investments among medical students and interns of Mumbai with the aim of identifying gaps in financial literacy and highlighting the need for intervention. This study will contribute to existing literature on financial awareness amidst Indian Medical graduates and help in guiding the development of comprehensive financial education programs.

MATERIAL AND METHODS

Study design

We conducted a cross-sectional study to evaluate the financial knowledge, attitudes and practices of medical students, using an online questionnaire distributed through WhatsApp.

Study site and population recruitment

The study was conducted through Google Forms. The questionnaire link was initially shared with students from various medical colleges in Mumbai and its periphery, who were then encouraged to forward it within their networks, through WhatsApp.

Study duration

This study spanned 6 months, covering phases of participant engagement, data collection and data analysis.

Sampling method

We employed a two-tiered sampling approach: Initially, convenience sampling targeted students at a specific medical college; this was followed by snowball sampling to extend reach within the college network.

Selection criteria

Participants for the study were carefully chosen from a specific demographic: Those actively enrolled in an undergraduate medical program or currently engaged in an internship at a medical college in Mumbai. Essential to their selection was not only their educational or professional status but also their willingness to participate in the research. Each participant was required to provide informed consent, ensuring they were fully aware of and agreeable to the study’s objectives, procedures and any potential implications of their involvement.

Study procedure

Post-ethical clearance, necessary permissions were secured from medical institutions. Potential participants were informed about the study through information sessions or emails, and those interested were enrolled for data collection.

Instrumentation and data collection

The questionnaire was developed collaboratively with finance experts and medical education professors to ensure relevance and accuracy. It achieved a content validity ratio of over 0.65, confirming its appropriateness for the study.

RESULTS

Demographic profile

The study sampled 280 medical students, revealing a gender distribution of 171 males (61%) and 109 females (39%). Age-wise, participants ranged between 18 and 24 years. In the survey, there were 183 1st-year, 44 2nd-year, 24 3rd-year and 17 final-year medical students.

Knowledge and perception about investing

A significant 79% (221) of students were familiar with the procedure to initiate investments, specifically highlighting the need for a Demat account and a permanent account number (PAN) card. Active participation in the stock market was noted among 60% (168) of the participants. On the other hand, 40% (112) were not engaged in stock market activities. Opinions regarding the stock market were evenly divided. A slight majority (52%) perceived it as a gamble, whereas 48% (134) did not share this sentiment [Table 1].

| Question | Yes (%) | No (%) |

|---|---|---|

| Do you know the procedure to start investing? | 79 (221) | 21 (59) |

| Do you actively invest? | 60 (168) | 40 (112) |

| Do you feel the stock market is a gamble? | 52 (146) | 48 (134) |

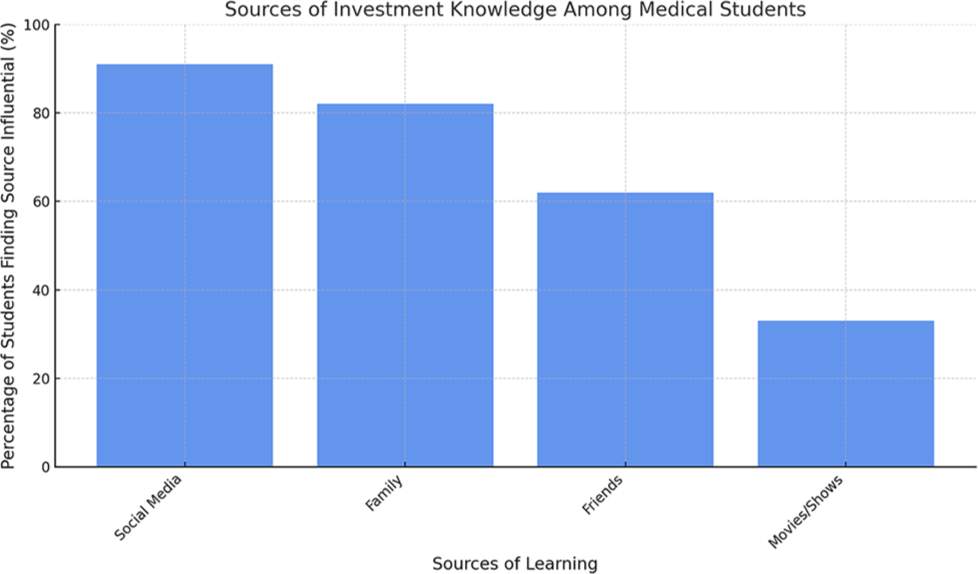

Sources of investment knowledge

The role of digital platforms became evident when 91% (255) of the participants identified social media channels, predominantly YouTube and Instagram, as their primary source of investment knowledge. Traditional influencers, such as family, still hold considerable sway, as cited by 82% (230) of the students. Friends were instrumental in guiding 62% (174) of the participants, and media in the form of shows and movies informed 33% (92) [Table 2 and Figure 1].

| Medium | Yes (%) | No (%) |

|---|---|---|

| Social Media (YouTube and Instagram) | 91 (255) | 9 (25) |

| Family | 82 (230) | 18 (50) |

| Friends | 62 (174) | 38 (106) |

| Movies/Shows | 33 (92) | 67 (188) |

- Primary Sources of Investment Knowledge Among Medical Students. This figure shows that social media platforms like YouTube and Instagram are the most common sources (91%), followed by family (82%), friends(62%) and movies/shows (33%).

Investment trends among participants

Diving into the investment habits, 36% (101) of the students revealed that they had been investing for <6 months. A close 34% (95) had embarked on their investment journey between 6 months and a year prior. Notably, a minimal 5% (14) were non-investors at the survey’s time. Among the active investors, 25% (70) had their investments running for over a year.

Portfolio management

Self-reliance emerged prominently in investment management. Among those who invested, 75% (210) took charge of their portfolios without external management.

Interest in attending a seminar for financial literacy

A significant 76% (213) of students expressed the belief that there is a necessity for either a seminar or the integration of basic education into the curriculum specifically focused on financial literacy.

DISCUSSION

Knowledge gap in financial literacy among Indian medical students

This study reveals a significant knowledge gap in financial literacy among Indian medical students. Although 60% of participants reported actively investing and managing their own portfolios, this does not necessarily imply sufficient financial knowledge. The majority rely on social media platforms which may provide limited insight. The strong interest (76%) in the introduction of financial education into the curriculum implies that even active investors feel underprepared, highlighting the need for structured financial literacy programs attuned to medical students’ unique challenges and time constraints.

Gender differences are evident in investment practices;7 males favour riskier strategies for higher returns, while females prefer safer, gradual investments. This underscores the need for gender-specific financial education to foster informed decision-making. Medical students predominantly invest in equity and mutual funds, aligning with national trends, but a growing interest in cryptocurrencies8 suggests a need for education on diverse investment options. The majority invest long-term, indicating a promising financial mindset. However, males tend to invest for longer periods than females,9 highlighting a need to encourage long-term investment among female students. Common barriers to investing include a lack of knowledge, emphasising the importance of financial education during medical training. Younger students show more interest in investing,10 suggesting the benefit of introducing financial literacy early in medical education.

Attitudes toward investment and financial planning

Medical students generally exhibit a cautious but optimistic attitude toward financial planning. While recognising its importance, many hesitate due to limited knowledge and experience. There is a consensus on the need for financial literacy, but a reluctance to engage in complex investments highlights the necessity for more comprehensive financial education.

Investment practices among medical students

Medical students’ investment practices vary, reflecting diverse financial backgrounds and literacy levels. While some actively engage in stocks and mutual funds, others, hindered by a lack of confidence and understanding, prefer safer options like fixed deposits. About 52% of participants viewed the stock market as a gamble underscoring the lack of confidence and a foundational financial understanding [Table 3]. This pattern indicates the need for educational programs that build knowledge and confidence in diverse investment strategies.

| Category | Subcategory | Description | Percentage | Number of participants |

|---|---|---|---|---|

| Demographic information | Total participants | 280 | ||

| Gender distribution | Male | 61 | 171 | |

| Gender distribution | Female | 39 | 109 | |

| Age range | 18–24 years | |||

| Year of study | 1st -year | 65 | 183 | |

| Year of study | 2nd -year | 16 | 44 | |

| Year of study | 3rd -year | 9 | 24 | |

| Year of study | Final-year | 6 | 17 | |

| Knowledge and perception about investing | Do you know the procedure to start investing? | Yes | 79 | 221 |

| Do you know the procedure to start investing? | No | 21 | 59 | |

| Do you actively invest? | Yes | 60 | 168 | |

| Do you actively invest? | No | 40 | 112 | |

| Do you feel the stock market is a gamble? | Yes | 52 | 146 | |

| Do you feel the stock market is a gamble? | No | 48 | 134 | |

| Sources of investment knowledge | Social Media (YouTube and Instagram) | Yes | 91 | 255 |

| Social Media (YouTube and Instagram) | No | 9 | 25 | |

| Family | Yes | 82 | 230 | |

| Family | No | 18 | 50 | |

| Friends | Yes | 62 | 174 | |

| Friends | No | 38 | 106 | |

| Movies/shows | Yes | 33 | 92 | |

| Movies/shows | No | 67 | 188 | |

| Investment trends among participants | Investing for<6 months | 36 | 101 | |

| Investing for 6 months–1 year | 34 | 95 | ||

| Investing for over 1 year | 25 | 70 | ||

| Non-investors | 5 | 14 | ||

| Portfolio management | Self-managed investments | Yes | 75 | 210 |

| Self-managed investments | No | 25 | 70 | |

| Interest in financial literacy initiatives | Interested in attending financial literacy seminar or course integration | Yes | 76 | 213 |

| Interested in attending financial literacy seminar or course integration | No | 24 | 67 |

Implications and recommendations for financial education

Several studies demonstrate that financial literacy programs have a significant positive impact on objective financial outcomes. These interventions have been shown to increase savings rates, improve investment behaviour and enhance debt management such findings support the need for similar educational programs in medical training to equip students with the skills necessary for managing their financial futures.11,12 Courses should cover personal finance, investment strategies and long-term planning, addressing unique challenges such as educational debts and delayed earnings. Practical applications through workshops and mentorships, along with financial wellness programs, are essential. Thus, evidence from literature and results from this study underscore the need for integrating financial literacy into the medical curriculum.

In addition, developing entrepreneurship cells in medical colleges could foster entrepreneurial skills, benefiting students’ financial stability and innovative contributions to healthcare.13

These comprehensive educational approaches are crucial for preparing well-rounded medical professionals capable of managing the clinical and financial aspects of their careers.

Limitations of the study

The study, ‘Financial Literacy and Investment Patterns among Indian Medical Undergraduates’, is limited by its cross-sectional design and its focus exclusively on Mumbai. This geographical constraint means the results might not accurately represent medical undergraduates in other areas, potentially limiting the study’s broader applicability. In addition, the overrepresentation of 1st year medical students, who do not have enough exposure to the complexities of financial planning and investment, may limit the generalizability of our findings.

CONCLUSION

This study, exploring financial literacy and investment patterns among Indian medical undergraduates, reveals a significant gap in financial knowledge and practices within this demographic. The study not only highlights the current deficiencies in financial understanding among medical students but also suggests the potential benefits of tailored financial education programs. By equipping future medical professionals with essential financial skills, we can enhance their personal and professional stability, thereby contributing positively to the broader medical ecosystem.

Ethical approval

The research/study approved by the Institutional Review Board at KEM Hospital, number EC/OA-42/2021, dated 10th October 2021.

Declaration of patient consent

The authors certify that they have obtained all appropriate patient consent.

Conflicts of interest

There are no conflicts of interest.

Use of artificial intelligence (AI)-assisted technology for manuscript preparation

The authors confirm that they have used artificial intelligence (AI)-assisted technology for assisting in the writing or editing of the manuscript or image creations.

Financial support and sponsorship

Nil.

References

- Rising Medical Education Debt a Mounting Concern. Graduates Also Face Less Favorable Repayment Terms. Shortage of Training Positions. Mo Med. 2012;109:266-70.

- [Google Scholar]

- Financial Difficulty in the Medical Profession. J R Soc Med. 2023;116:160-6.

- [CrossRef] [PubMed] [Google Scholar]

- Financial Literacy and Physician Wellness: Can a Financial Curriculum Improve an Obstetrician/Gynecologist Resident and Fellow's Well-Being? AJP Rep. 2022;12:e64-8.

- [CrossRef] [PubMed] [Google Scholar]

- Effect of Medical Student Debt on Mental Health, Academic Performance and Specialty Choice: A Systematic Review. BMJ Open. 2019;9:e029980.

- [CrossRef] [PubMed] [Google Scholar]

- The Importance of Financial Literacy and Its Impact on Financial Wellbeing. J Financial Literacy Wellbeing. 2023;1:1-11.

- [CrossRef] [Google Scholar]

- The Case for Needed Financial Literacy Curriculum during Resident Education. J Surg Educ. 2023;80:597-612.

- [CrossRef] [PubMed] [Google Scholar]

- How Does Gender Really Affect Investment Behavior? Econ Lett. 2017;151:58-61.

- [CrossRef] [Google Scholar]

- The Evolution of Cryptocurrencies in India and What the Future Looks Like. 2022. Times of India. Available from: https://timesofindia.indiatimes.com/blogs/voices/the-evolution-of-cryptocurrencies-in-india-and-what-the-future-looks-like/ [Last accessed on 2024 Aug 14]

- [Google Scholar]

- Boys Will be Boys: Gender, Overconfidence, and Common Stock Investment. Quarter J Econ. 2001;116:261-92.

- [CrossRef] [Google Scholar]

- Increasing Number of Youngsters Directly Investing in Equities: Survey. 2021. Times of India. Available from: https://timesofindia.indiatimes.com/business/india-business/increasing-number-of-youngsters-directly-investing-in-equitiessurvey/articleshow/87514636.cms [Last accessed on 2024 Aug 14]

- [Google Scholar]

- The Importance of Financial Education: Evidence from Research and Practical Experiences. 2016. European Investment Bank. Available from: https://institute.eib.org/wp-content/uploads/2016/10/financial-edu.pdf [Last accessed on 2024 Aug 14]

- [Google Scholar]

- The Economic Importance of Financial Literacy: Theory and Evidence. J Econ Lit. 2014;52:5-44.

- [CrossRef] [PubMed] [Google Scholar]

- The Impact of Early Entrepreneurship Education on Financial Literacy. Financial Express;.

- [Google Scholar]